Bitcoin trading can make you money. But it’s hard work. The market never stops moving, even when you sleep.

You wake up and Bitcoin is up 5%. You go to work and it drops 8%. By lunch, it’s climbing again. You miss every move.

This happens to everyone. You can’t watch charts 24 hours a day. You have a life, a job, and need sleep.

What if a computer could trade for you? What if it never got tired, never got scared, and never made emotional mistakes?

That’s exactly what trading bots do. They’re computer programs that buy and sell Bitcoin automatically. They follow rules you set up.

These bots work while you sleep. They trade while you’re at work. They never take breaks or get distracted.

Some people make hundreds of dollars daily using these bots. Others earn thousands. The best part? You don’t need to be a computer expert.

Modern trading bots are simple to use. You set them up once and let them work. No coding required. No complex charts to read.

But not all bots are equal. Some are scams. Others are too complicated. Many don’t work as promised.

This guide shows you the real winners. We tested dozens of trading bots. These 10 actually make money for regular people.

Why Bitcoin Trading Bots Matter

Bitcoin trading bots execute trades based on pre-programmed strategies. They analyze market data faster than humans ever could.

These tools remove emotion from trading decisions. Fear and greed often lead to poor choices. Bots stick to logic.

The best part? They work around the clock. No more staying up all night watching charts or missing golden opportunities during work hours.

How Trading Bots Generate Profits

Trading bots use various strategies to generate returns. Some focus on arbitrage, buying low on one exchange and selling high on another.

Others use technical analysis, reading chart patterns and indicators. Advanced bots even incorporate machine learning to adapt to market conditions.

Dollar-cost averaging bots make regular purchases regardless of price. This strategy smooths out volatility over time.

Grid trading bots place multiple buy and sell orders at different price levels. They profit from market fluctuations within a specific range.

Top Bitcoin Trading Bots in 2025

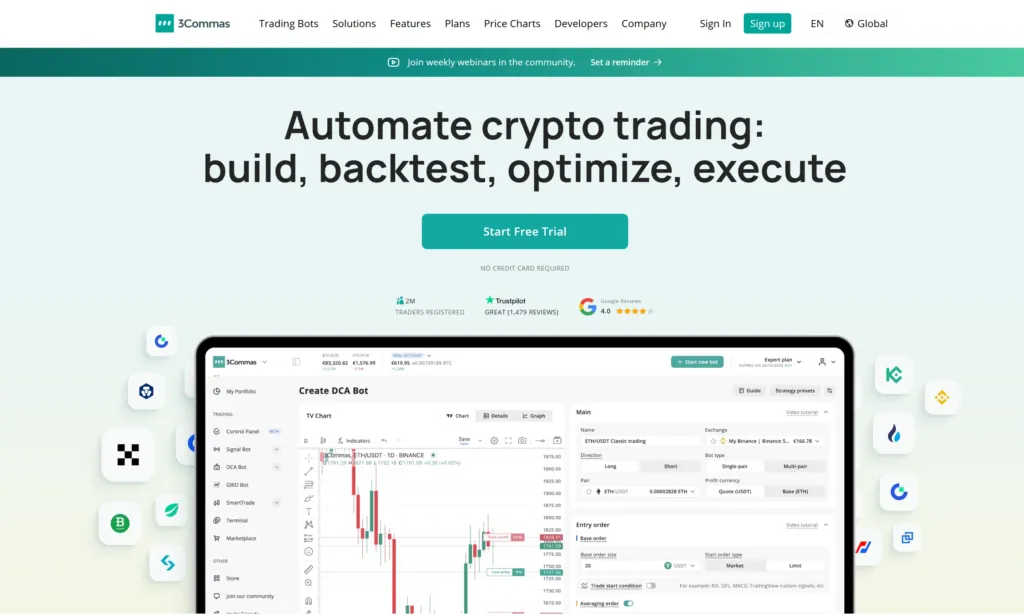

1. 3Commas

3Commas stands out for its user-friendly interface and powerful features. The platform connects to major exchanges seamlessly.

Their DCA (Dollar Cost Averaging) bots are particularly effective. You can set up complex strategies without coding knowledge.

The platform offers paper trading to test strategies risk-free. Smart trading terminals provide advanced order types and portfolio management.

Social trading features let you copy successful traders’ strategies. The mobile app ensures you stay connected on the go.

Key Features:

- Multi-exchange support

- Pre-built bot templates

- Advanced portfolio tracking

- Copy trading functionality

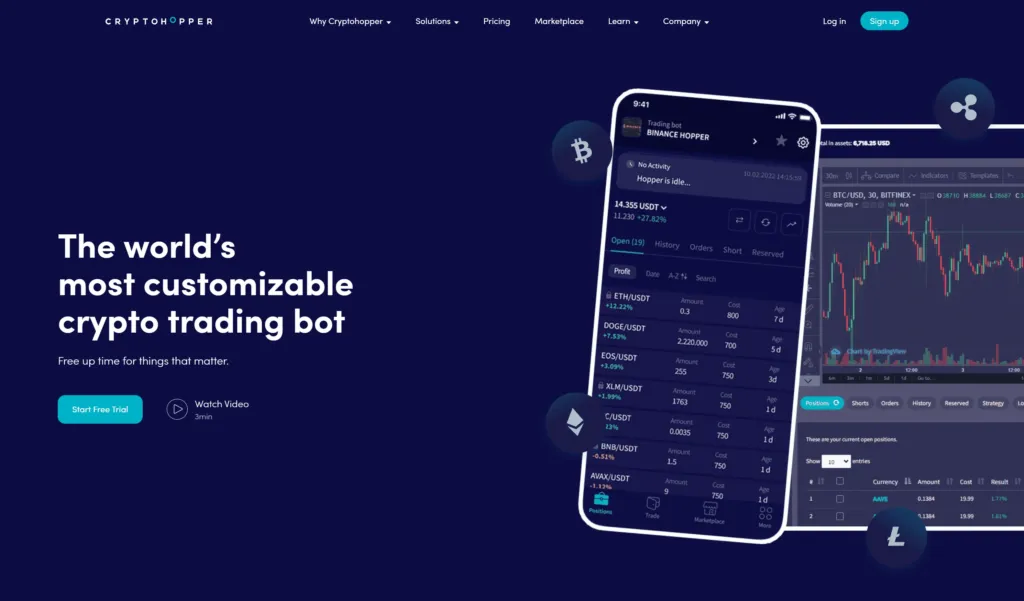

2. Cryptohopper

Cryptohopper combines automation with social trading brilliantly. Their marketplace offers thousands of pre-made strategies.

The platform includes technical analysis tools and backtesting capabilities. You can fine-tune strategies before risking real money.

Mirror trading allows copying successful traders automatically. The strategy designer helps create custom trading rules without programming.

Cloud-based operation ensures your bots run continuously. Email notifications keep you informed of important trades.

Key Features:

- Strategy marketplace

- Technical analysis integration

- Mirror trading options

- Cloud-based automation

3. TradeSanta

TradeSanta focuses on simplicity without sacrificing functionality. Their long and short bot strategies cater to different market conditions.

The platform excels at grid trading and DCA strategies. Risk management tools help protect your capital effectively.

Template-based bot creation makes setup incredibly easy. The interface remains clean and intuitive throughout.

Performance analytics provide detailed insights into bot effectiveness. Mobile apps ensure constant access to your trading activity.

Key Features:

- Grid and DCA strategies

- Template-based setup

- Comprehensive analytics

- Mobile accessibility

4. Pionex

Pionex is unique as both an exchange and bot platform. This integration eliminates connection issues common with other services.

Their 16 built-in trading bots cover various strategies. The Grid Trading bot is particularly popular among users.

Low trading fees make frequent bot trading more profitable. The DCA bot helps accumulate Bitcoin systematically.

Leveraged grid trading amplifies potential profits. Copy trading features let you follow successful strategies automatically.

Key Features:

- Built-in exchange integration

- 16 pre-built bots

- Low trading fees

- Leveraged trading options

5. HaasOnline

HaasOnline targets serious traders with advanced requirements. Their customization options are virtually unlimited.

The platform supports complex trading strategies and indicators. Backtesting capabilities span years of historical data.

High-frequency trading support makes it suitable for professional use. Custom indicators and strategies can be programmed.

Multiple exchange connections run simultaneously. The learning curve is steep but rewards are substantial.

Key Features:

- Advanced customization

- Professional-grade tools

- Extensive backtesting

- Multi-exchange support

6. Bitsgap

Bitsgap combines trading bots with portfolio management effectively. Their arbitrage scanner identifies profit opportunities across exchanges.

Grid bots work exceptionally well in sideways markets. The platform supports both spot and futures trading.

Smart orders include trailing stops and conditional orders. Portfolio tracking spans multiple exchanges and wallets.

Demo mode lets you practice without financial risk. Educational resources help improve trading knowledge.

Key Features:

- Arbitrage scanning

- Grid trading focus

- Portfolio management

- Educational resources

7. Quadency

Quadency offers institutional-grade features for retail traders. Their bot performance analytics are exceptionally detailed.

The platform includes risk management tools and stop losses. Strategy backtesting uses comprehensive historical data.

Social trading features enable strategy sharing. The interface balances power with usability effectively.

Free tier includes basic bot functionality. Premium features unlock advanced strategies and analytics.

Key Features:

- Institutional-grade tools

- Detailed analytics

- Risk management focus

- Free tier available

8. Coinrule

Coinrule excels at making automation accessible to beginners. Their if-this-then-that approach simplifies strategy creation.

Pre-built templates cover common trading scenarios. The rule builder uses plain English instead of code.

Strategy simulation shows potential performance. Multiple exchange support ensures broad market access.

Mobile app functionality matches desktop capabilities. Customer support responds quickly to user questions.

Key Features:

- Beginner-friendly interface

- Plain English rules

- Strategy simulation

- Excellent support

9. Shrimpy

Shrimpy focuses on portfolio rebalancing and social trading. Their index fund approach reduces individual coin risk.

Automatic rebalancing maintains target allocations. Social trading lets you follow top performers automatically.

Backtesting shows historical strategy performance. The platform supports multiple major exchanges.

Portfolio analytics provide deep performance insights. Dollar-cost averaging features smooth out volatility.

Key Features:

- Portfolio rebalancing

- Index fund approach

- Social trading focus

- Comprehensive analytics

10. WunderTrading

WunderTrading combines multiple services into one platform. Their copy trading system includes performance guarantees.

Signal providers undergo strict verification processes. The platform offers both automated and manual trading options.

Risk management tools include stop losses and position sizing. Multiple asset classes beyond cryptocurrency are supported.

Educational content helps improve trading skills. The interface accommodates both beginners and experts.

Key Features:

- Copy trading guarantees

- Multi-asset support

- Verified signal providers

- Educational focus

Choosing the Right Bot for Your Needs

Consider your experience level when selecting a bot. Beginners should prioritize ease of use over advanced features.

Budget constraints matter significantly. Some platforms charge monthly fees while others take percentage cuts.

Exchange compatibility is crucial. Ensure your chosen bot works with your preferred trading platforms.

Strategy preferences should guide your decision. Some bots excel at specific approaches like grid trading or DCA.

Setting Up Your First Trading Bot

Start with small amounts while learning. Even the best bots can lose money in certain market conditions.

Paper trading helps you understand bot behavior without financial risk. Most platforms offer this feature.

Monitor bot performance regularly initially. Adjustments may be needed as market conditions change.

Set clear profit targets and stop-loss levels. This protects your capital during unexpected market moves.

Risk Management Strategies

Never invest more than you can afford to lose. Cryptocurrency markets remain highly volatile and unpredictable.

Diversify across different bot strategies and timeframes. This reduces the impact of any single strategy failing.

Regular monitoring prevents small losses from becoming large ones. Automated doesn’t mean hands-off entirely.

Keep some funds in reserve for manual trading opportunities. Bots can’t capture every profitable situation.

Common Mistakes to Avoid

Over-optimization based on historical data rarely works in live markets. Past performance doesn’t guarantee future results.

Neglecting security measures puts your funds at risk. Use strong passwords and two-factor authentication always.

Ignoring market conditions can lead to poor bot performance. Bear markets require different strategies than bull markets.

Unrealistic expectations often lead to disappointment. Even the best bots can’t guarantee profits consistently.

Maximizing Bot Performance

Regular strategy updates keep bots effective as markets change. What works today might fail tomorrow.

Backtesting new strategies before implementation reduces risk. Historical data provides valuable performance insights.

Combining multiple bots can improve overall performance. Different strategies excel in different market conditions.

Staying informed about market news helps anticipate bot performance. Major events often disrupt automated strategies.

Security Considerations

API key management is crucial for bot security. Never share keys or grant unnecessary permissions.

Choose platforms with strong security records. Research any platform’s history before trusting them with funds.

Regular security audits of your setup prevent compromises. Update passwords and review permissions periodically.

Cold storage for long-term holdings provides extra security. Keep only trading funds on exchanges.

Future of Bitcoin Trading Bots

Artificial intelligence integration will make bots smarter. Machine learning helps adapt to changing market conditions.

Regulatory clarity will improve platform reliability. Clear rules help legitimate services thrive.

Improved user interfaces will make automation more accessible. Complex strategies will become easier to implement.

Cross-chain trading will expand opportunities. Bots will work across multiple blockchain networks seamlessly.

Getting Started Today

Research thoroughly before committing significant funds. Each platform has unique strengths and weaknesses.

Start with free trials or demo accounts. This provides hands-on experience without financial risk.

Join communities and forums for peer insights. Other users share valuable experiences and strategies.

Begin with simple strategies before attempting complex ones. Build confidence and understanding gradually.

Final Words

Bitcoin trading bots offer powerful tools for automating your investment strategy. They work tirelessly while you focus on other priorities.

Success requires choosing the right platform for your needs. Consider experience level, budget, and preferred strategies carefully.

Remember that no bot guarantees profits consistently. Market conditions change, and strategies must adapt accordingly.

Start small, learn continuously, and never risk more than you can afford. With proper setup and management, trading bots can enhance your Bitcoin investment journey significantly.

The cryptocurrency market’s 24/7 nature makes automation increasingly valuable. Don’t let profitable opportunities slip away while you sleep.

Ready to start your automated trading journey? Choose a platform from our list above and begin with a small test amount today.